Last March, I was invited to speak at the University of North Carolina’s Center for Banking and Finance annual conference. The topic was “Advancing Small Businesses to Deliver a More Inclusive Economy.” During the presentation, I shared the importance of the Community Reinvestment Act (CRA) and its positive and significant impact on underserved small businesses. I also expressed my cautious optimism for the new CRA legislation. But mostly, I highlighted that the CRA is not a panacea – that banks need to go beyond the CRA to help realize the potential of all small businesses.

With the recent news that a Federal judge blocked the implementation of the CRA overhaul, I thought it time to reinforce why the CRA matters, why the rules need to be updated, and why the CRA is not a holistic solution for reducing the funding gap for BIPOC, women, and other underserved entrepreneurs.

Why does the Community Reinvestment Act Matter?

Next Street’s research across the country has shown that bank lending remains the primary vehicle for small business owners to fund starting, maintaining, and growing a business, despite the influx of traditional and alternative debt and equity financing vehicles. We also know that access to credit continues to be one of the biggest challenges small business owners face – and the barriers to accessing credit are particularly pronounced for BIPOC- and women-owned businesses.

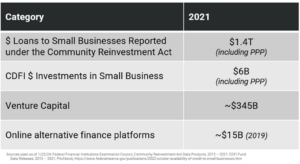

Since its beginnings in 1977, the Community Reinvestment Act has funneled over a trillion dollars to underserved small businesses that would not otherwise have been available or accessible. Loans to small businesses reported under the CRA dwarfed loans to small businesses from CDFIs, venture capital, and alternative financing platforms.

Through our national research, we find the biggest gap in capital access is between $25,000 and $250,000, commonly sought by businesses with revenue under $1M. Particularly noteworthy from the FFEIC, measured by number of loan originations, about 87.5 percent of the small business loans and 78.1 percent of the small farm loans originated in 2020 under the CRA were for amounts under $100,000.

Out with the Old: Why CRA Rules Need to Be Updated

Though the Community Reinvestment Act continues to be one of the biggest drivers of small business development, reform was a long time coming. Even most banks, regulatory agencies, community organizations, and trade associations agree that the CRA needs a refresh. The legislation and rules were built prior to the advent of online banking and bank and branch consolidation.

The debate over overhauling the CRA has been about the how, not the why. In a blog that we produced in 2019, we recommended addressing CRA deposits, adding deposit-based measures in addition to facility-based measures to broaden the geographies where the CRA can have an impact. We also recommended a focus on people, not place. And, we welcomed standardization and clarity with the new rules.

Next Street was not alone in sharing our opinions. There was a lot of feedback for the three bank regulatory agencies to consider. It took years (and multiple administrations) to get to a point where the OCC, Federal Reserve, and the FDIC were able to align and issue a final rule to strengthen and modernize the Community Reinvestment Act.

While the new rules are not perfect (with nearly 1,500 pages to digest, it’s overly complex and potentially difficult to implement) they do reflect advances in technology, including mobile and online banking, and work to solve for inequity in credit access. The new rules also work towards more transparency and increased data and reporting requirements for banks. The place-based requirements include revitalization and stabilization and include native lands. And the revamped testing requirements will recognize different benchmarks reflecting the communities themselves.

One Size Does Not Fit All: Why the Community Reinvestment Act is Not a Holistic Solution

As noted in our 2019 blog, when it was enacted, the Community Reinvestment Act had two missions: 1) take aim at the redlining that adversely affects people of color and 2) promote neighborhood revitalization in low-to-moderate income (LMI) communities. But the CRA legislation does not address the deep systemic and complex issues that led to financial exclusion. Still today:

- Credit and risk officers and executives often do not have a fundamental understanding of the challenges underserved business owners face. The majority of bank credit and risk executives still do not reflect the rise of women, AAPI, and black and brown business owners.

- Antiquated credit boxes often leave out many underserved businesses. Credit boxes use decades old systems of evaluation that have unintentional biases baked in.

- Loan products are antiquated. They often require personal guarantees and collateral, which can be challenging requests for underserved businesses.

In and of itself, the CRA rules (old and new) are fundamentally flawed as benchmarking over-emphasizes volume thus disproportionately encouraging simpler transactions. We encourage responsible risk-taking to serve a broader range of small businesses.

How Banks can go Beyond the CRA to Help Underserved Small Businesses

The Community Reinvestment Act has helped small business development in underserved markets and amongst underrepresented groups, which has led to more equitable growth.

We believe the new CRA legislation, while not perfect, will modernize the rules and further small business growth and access to capital.

But the CRA is not enough – it’s not going to fix the systemic issues that plague women and BIPOC small business owners. And with new rules postponed (they were expected to be effective on April 1, 2024 with banks having till January 1, 2026 to comply with most provisions and data to be reported the following year), underserved businesses need banks to do more now. For starters, we recommend banks:

- Fulfill the diversity and equity commitments that were made following the murder of George Floyd. Much of the money has yet to be spent.

- Reduce the small business funding gap by challenging the status quo of credit boxes and developing innovative product offerings.

- Invest in diverse supplier programs to increase opportunities for BIPOC and women business owners.

- Hire/ train decision makers who understand the challenges that underserved small businesses face.

BIPOC- and women-owned small businesses are some of the fastest growing in the U.S. If banks get their support for these populations right (through the CRA and outside of the CRA), they will be rewarded with their business.